Gambling can be a fun and exciting activity, but it is important to understand the tax implications of any winnings you may receive. Whether you hit the jackpot at a casino like UFACAM or win big at a poker tournament, you will be required to report your winnings on your tax return.

Report Gambling Winnings

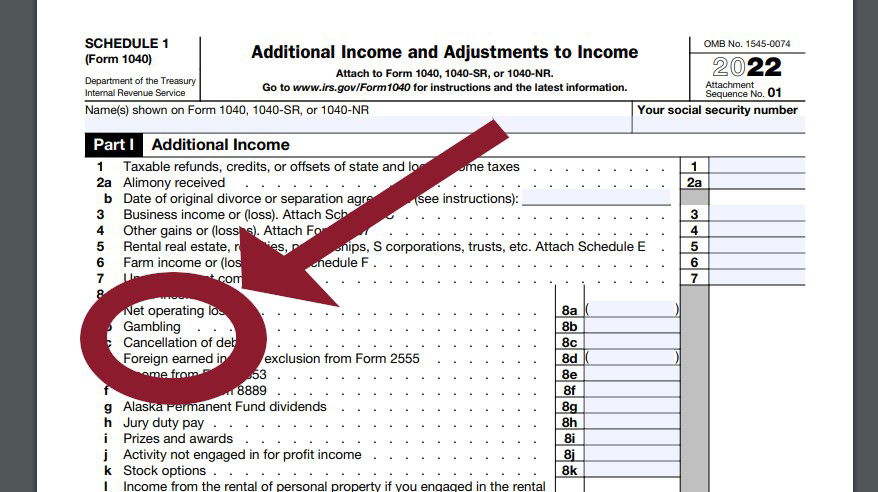

According to the Internal Revenue Service (IRS), gambling winnings are considered taxable income. This means that any money you win from gambling must be reported on your tax return and is subject to federal income tax. Depending on where you live, you may also be required to pay state and local taxes on your gambling winnings. In any case, you will report your winnings using the SCHEDULE 1 (Form 1040):

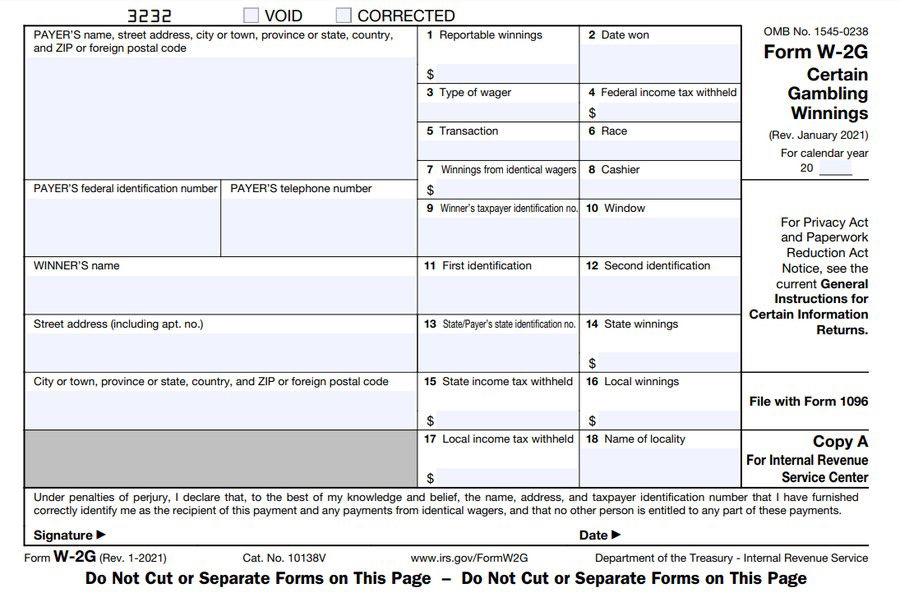

When you receive your gambling winnings, the casino or other gambling establishment will typically issue you a Form W-2G, which reports the amount of your winnings and the taxes that were withheld. The IRS also receives a copy of this form, so it is important to make sure that the information on it is accurate. A printscreen of the Form can be seen bellow:

Minimum value to issue a Form W-2G

The payer must furnish a Form W-2G if they receive:

- 1. $1,200 or more in gambling winnings from bingo or slot machines;

- 2. $1,500 or more in winnings (reduced by the wager) from keno;

- 3. More than $5,000 in winnings (reduced by the wager or buy-in) from a poker tournament;

- 4. $600 or more in gambling winnings (except winnings from bingo, keno, slot machines, and poker tournaments) and the payout is at least 300 times the amount of the wager; or

- 5. Any other gambling winnings subject to federal income tax withholding.

How much Tax is payed

The tax rate on gambling winnings depends on the amount you win and your overall taxable income for the year. If you are a high earner, you may be subject to the top federal tax rate of 37% on your gambling winnings. Additionally, some states impose their own tax on gambling winnings, which can range from a few percent to as much as 10%.

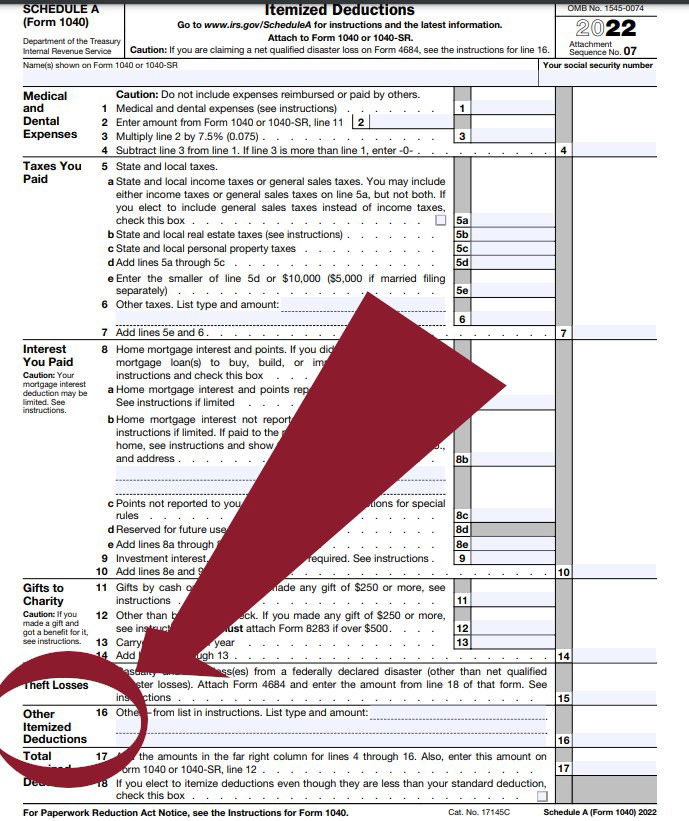

Report Gambling Losses

While gambling winnings are taxable, you may be able to deduct your gambling losses on your tax return, up to the amount of your winnings. However, you must be able to provide documentation of your losses, such as receipts or other records, and you must itemize your deductions rather than taking the standard deduction. The amount of losses you deduct can't be more than the amount of gambling income you reported on your return. Claim your gambling losses up to the amount of winnings, as "Other Itemized Deductions." on Schedule A (Form 1040).

Exceptions to the Rules

While it is true that gambling winnings are generally taxable income, there are some exceptions to the rules that may apply in certain situations. Here are some examples of when gambling winnings may not be taxed:

- Winnings from certain types of games: Some types of gambling winnings are not subject to federal income tax, such as winnings from a raffle, lottery, or sweepstakes. However, it is important to note that state and local taxes may still apply.

- Gambling losses exceed winnings: If you have more gambling losses than winnings for the year, you may be able to deduct those losses on your tax return. However, you must be able to provide documentation of your losses, such as receipts or other records, and you must itemize your deductions rather than taking the standard deduction.

- Casual gamblers: If you only gamble occasionally and your winnings are relatively small, you may not have to pay any taxes on your winnings. However, the IRS may still require you to report your winnings on your tax return.

- Nonresident aliens: If you are a nonresident alien and your gambling winnings are not effectively connected with a trade or business in the United States, they are generally not subject to federal income tax.

- Tribal casinos: If you win money at a tribal casino on an Indian reservation, you may not be required to pay federal income tax on your winnings. However, state and local taxes may still apply.

It is important to note that the rules regarding gambling winnings and taxes can be complex, and there are many factors that can affect how your winnings are taxed.

Conclusion

In conclusion, gambling in casinos while playing a card deck game like Blackjack can be a thrilling experience, but it is essential to understand the tax implications of any winnings and losses. In most cases, gambling winnings are considered taxable income and must be reported on your tax return. The tax rate on gambling winnings depends on the amount you win and your overall taxable income for the year, and you may also be required to pay state and local taxes on your winning

— تعليقات 0

, ردود الفعل 1

كن أول من يعلق