The fear and greed indicator represents a tool that gauges the market sentiment and expresses the intensity of the emotion on a scale from 0 to 100. It relies on multiple data sources and merges them into a single figure, presenting a result that helps categorize the market sentiment. That is, extreme greed ranges between 75 and 100 scores, and extreme fear ranges from 0 to 24. Since Bitcoin is the market's leader, the indicator is mainly based on its market data.

When fear dominates, prices tend to drop, and when greed prevails, prices often surge. Understanding this index can help traders make informed decisions and avoid taking irrational actions based on impulse or fear of missing out, among other psychological triggers. Let's discover how the fear and greed index works, its main elements, and its calculation methods. This will help you determine whether it can be a worthy baseline for your trading.

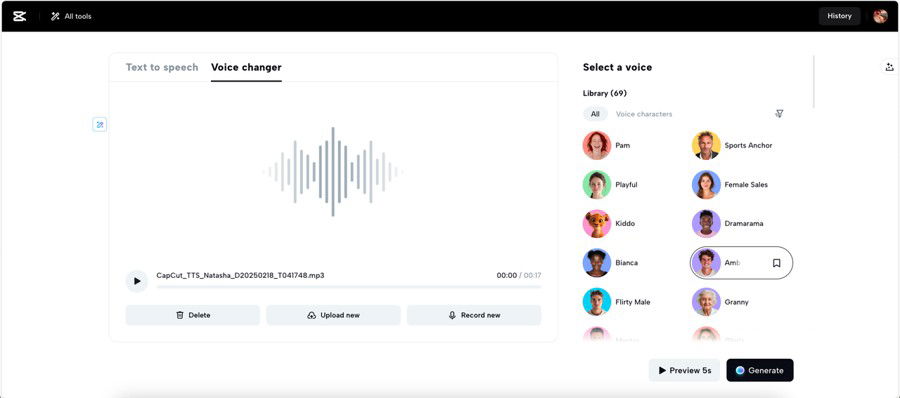

A snapshot of the indicator

The crypto fear and greed index gauges market sentiment to quantify feelings impacting crypto investors' decisions. For this reason, whenever the emotion is high, prices tend to swing suddenly. The tool was developed in 2018 by Alternative.me, inspired by the same tool created for traditional markets and offered by CNN Money. This indicator first grabbed the headlines during 2017's bull market when Bitcoin's volatility was a hot topic. A conglomerate of elements, including market momentum, trading volume, volatility, and social media spin, points to whether fear or greed is rampant at a given moment. Seasoned investors usually employ the tool as a contrarian signal, opting to purchase when fear is at its highest and sell when greed takes over the market.

How the index works

When markets decline, fear often leads investors to panic sell, whereas greed during rallies can spark impulsive buying driven by the fear of missing out. The index combines diverse indicators to create a numerical assessment of investor sentiment in real-time.

An index value near zero indicates widespread fear, typically observed during significant market downturns or corrections. On the other hand, a score edging toward 100 indicates extreme greed, potentially forecasting an impending market correction.

Here's a quick representation:

● A 0-24 score indicates excessive fear

● A 25-49 mark suggests moderate fear

● The 50 level signifies neutrality

● A 51-74 score is indicative of moderate greed

● The 75-100 level signals extreme greed.

These variables contribute to the index's shaping

A few factors contribute to calculating market sentiment and provide a comprehensive view of the sector's psychology.

Market volatility

Market volatility is a hallmark of the industry and a powerful force that can trigger price changes and emotional swings. Sudden price adjustments often indicate high emotion, whether it's fear or greed. When Bitcoin and the rest of the cryptocurrencies interfere with excessive fluctuations, the tool adjusts to mirror the emotion driving the market.

Social media spin

Crypto-based discussions on social media channels are highly indicative of the market's emotions. A spike in enthusiastic conversations can reflect a desire to buy, while an abundance of panic-driven chats indicates anxiety. Platforms like Telegram, Reddit, and X impact the indicator by bringing light to the investor's mood. For instance, negative conversations usually correlate with market drops, while high positive feelings reflect excitement.

This indicator aggregates social media buzz to gauge sentiment and show whether the outlook is bullish or bearish.

Search trends

Search engine data helps gauge investor sentiment. Search trends, or Google trends represented by keywords like "crypto crash" or "Bitcoin sell-offs," indicate fear, while queries such as "is now the best time to buy crypto" suggest growing greed. The index weighs Google search trends to understand public sentiment.

Bitcoin dominance

Bitcoin's dominance in the market indicates investor sentiment shifts. When its market share increases, traders may be seeking safety, signaling fear. A drop in dominance suggests risk-taking behavior, often associated with greed.

Derivatives market activity

A surge in leveraged trades, be they short or long, can highlight excessive optimism or panic in the market.

Integrating the tool into trading

Some traders integrate the fear and greed indicators into their analysis process to stay updated on market sentiment and how it can precede turning points. Historically, there's a connection between potential market upturns and powerful feelings taking over the market, but nothing can predict future results. Crypto deals with a lot of volatility, and the fear and greed index is just one of the numerous market analysis solutions out there.

Traders also assess price blockchain data, trends, volume, and broader economic factors. Keep in mind that all markets, especially crypto, come with significant risks you should better acknowledge before spending a fortune.

The index's advantages

The index's main advantage is its capacity to express in numbers the emotions prevailing on the market through measurable data points. All the metrics incorporated eventually result in an unbiased perspective on market psychology, a perk that goes beyond mere price fluctuations. Regular updates and historical assessments help traders keep a finger on the pulse of market trends and compare current with past market cycles and conditions.

One of the most significant parts of this tool is that it's readily accessible for both beginners and seasoned investors. It's user-friendly and straightforward, necessitating little research to understand the market participants' feelings better. By using this data-driven tool, you can eliminate emotional bias from your market-based evaluations.

The tool's limitations

As with any other analysis tool, this one brings about a series of limitations. First, its massive focus on Bitcoin restraints its pool of sources that can contribute to more accurate outcomes. Since it relies on public data, it might miss key elements like institutional trading flows or off-market deals. Moreover, the index looks at past sentiment data, which describes past conditions instead of forecasting future market changes. Market sentiment can change rapidly, especially after major news events, when the index is sluggish to update. Lastly, the calculation process doesn't permit users to check or improve how different factors are weighted to meet their individual needs.

The main takeaway: It's important to understand that while these trends are based on the past, they don't guarantee future price movements.

— Comentarios 0

, Reacciones 1

Se el primero en comentar