The move signals an intensifying competition among Southeast Asian countries to capture a share of the region's growing gaming market, following the proven success models of Singapore and the ongoing development in Japan.

Regional Gaming Evolution

Southeast Asia's gaming market continues its transformation from a landscape once dominated by limited options to one offering world-class integrated resorts. Thailand's recent decision to allow casino development within entertainment complexes reflects a broader regional trend toward regulated gaming markets that prioritize tourism development and economic growth.

Singapore: Setting the Gold Standard

Singapore's journey into casino gaming, initiated with the legalization of integrated resorts in 2005, has become the blueprint for regional success. The city-state's two integrated resorts - Marina Bay Sands and Resorts World Sentosa - have demonstrated the viability of the regulated casino model, generating substantial tourism revenue while maintaining strict regulatory oversight.

The Singapore model has proven particularly effective in balancing economic benefits with social responsibility. Local residents must pay a significant entry levy to access casinos, while the integrated resorts maintain a strong focus on non-gaming amenities, including convention facilities, theme parks, and luxury retail.

Japan's IR Vision Takes Shape

Japan has been one of the most attractive markets for online casino gambling for the last 15 years and with Japan's integrated resort development in Osaka, scheduled to open in 2030, it represents the next evolution in Asian gaming markets. The ¥1.27 trillion ($8.9 billion) project, led by MGM Resorts International and Orix, aims to create Japan's first integrated resort with a carefully controlled gaming floor space limited to 3% of the total area.

The Japanese model introduces unique features to address social concerns, including restrictions on local access and sophisticated responsible gaming measures. The Osaka IR project targets 20 million annual visitors, with plans to generate ¥520 billion ($3.6 billion) in yearly revenue.

Thailand Enters the Game

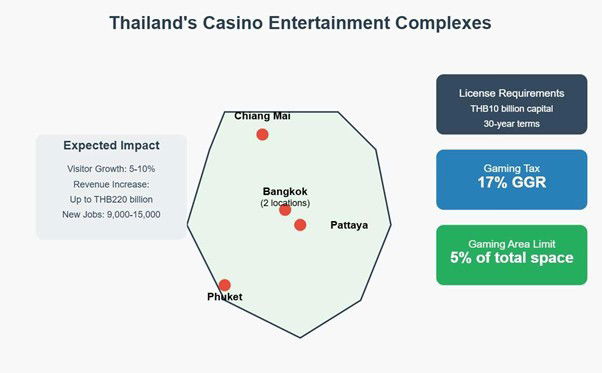

Thailand's recently approved Entertainment Complex Bill marks a significant shift in the country's gaming policy. The legislation permits casino development within large-scale entertainment complexes, with initial plans for five locations including Bangkok, Pattaya, and Phuket.

Key features of Thailand's gaming framework include:

● A 17% tax on gross gaming revenue

● Gaming areas limited to 5% of total resort space

● Minimum capital requirements of THB10 billion for license applicants

● 30-year license terms with regular evaluations

● Creation of a dedicated regulatory commission

The government projects the initiative will increase foreign visitor numbers by 5-10% and generate up to THB220 billion in additional tourism revenue, while creating 9,000-15,000 new jobs.

With the new Entertainment Complex bill being approved, the government is also proceeding with a bill to legalize online gambling. It’s well known that there are countless offshore online casinos targeting Thai players and it’s been a growing market, especially during the last couple of years. Casinohub888.com is one of the most prominent online gambling guides in Thailand, who provide Thai players with up to date reviews and articles. We reached out to Casinohub888 who told us that they are welcoming the legalisation of online casinos in Thailand.

Market Outlook and Regional Competition

The expansion of regulated gaming in Southeast Asia creates both opportunities and challenges for operators and jurisdictions. Singapore's established integrated resorts face increasing regional competition, while Japan's upcoming entry into the market will set new standards for luxury gaming experiences.

Thailand's entry into the market could reshape regional gaming dynamics, particularly given its strategic location and existing tourism infrastructure. However, success will depend on effective implementation of regulatory frameworks and the ability to differentiate offerings in an increasingly competitive market.

Looking Ahead

Southeast Asia's gaming landscape continues to evolve, with each jurisdiction adopting unique approaches to balance economic opportunities with social responsibility. As Thailand moves forward with its gaming legislation and Japan prepares for its first integrated resort opening, the region is positioned to become an increasingly significant player in the global gaming market.

The success of these new ventures will likely depend on their ability to learn from Singapore's experience while adapting to local market conditions and maintaining strong regulatory oversight. The next decade promises to reshape the region's gaming landscape significantly, with implications for operators, investors, and neighboring jurisdictions.

— 코멘트 0

, 반응 1

첫 댓글을 남겨보세요