Litecoin is a cryptocurrency that’s been around since 2011. Can this token still be a profitable investment after almost a decade in the market? Before you go, discover how to buy Litecoin, read our article that focuses on analyzing LTC and predicting its future performance.

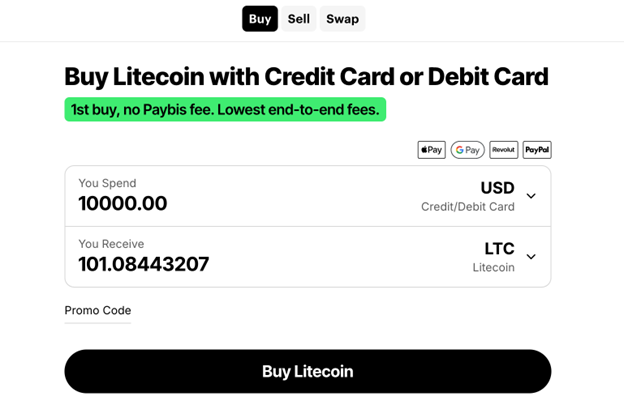

Here is a small step-by-step guide from Paybis on how to buy Litecoin:

- Create an account on Paybis.

- Choose the amount of Litecoin you want to buy and curenccy.

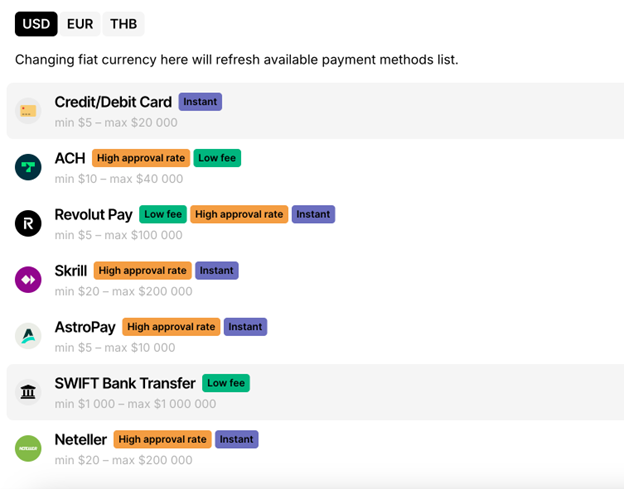

- Choose the payment method.

- Complete the purchase.

Here you go, now you know how to buy Litcoin. The next step is learn the Litecoin basics, discover the past and current market movements, and assess the prognosis regarding the future price of LTC!

What Is Litecoin?

Charlie Lee created Litecoin as an instant P2P internet payment method. Lee graduated from the Massachusetts Institute of Technology and had experience working at Google. He created Litecoin in 2011 and joined the Coinbase crypto platform in 2013. It put LTC development on hold until 2017. Lee then decided it was time to leave other jobs and solely work on Litecoin.

Litecoin is a worldwide payment network that utilizes LTC tokens for transactions. Blockchain technology is the foundation of Litecoin, and the creator took some inspiration from Bitcoin’s code. Litecoin’s chain has a design capable of processing more transactions per minute than BTC. It’s because it can generate a new block every 2.5 minutes. Bitcoin takes four times as much.

As open-source software, Litecoin features full decentralization. It’s similar to Bitcoin because they both use the proof-of-work method. The difference is that BTC uses computational power. LTC focuses on utilizing large memory amounts in addition to computational power. It relies on the Scrypt hashing function.

Litecoin’s Market Performance

LTC is currently worth $92.25. That puts it in the top 20 cryptocurrencies in the rankings. The project’s market cap is over $7.06 billion. Its trading volume is about $777 million daily, putting it at a decent level of 6% of the market cap.

The maximum supply for LTC tokens is 84 million. At the moment, over 76.53 million coins are in circulation. Each halving event reduces the amount of LTC available to make them scarce.

If we observe historical performance, Litecoin was at its lowest in 2015. It was worth $1.11. LTC continued having problems in the years to come. In 2017, when the developer focused on working on it full-time, LTC took off. In December 2017, Litecoin's value reached $280. LTC used the crypto boom well and increased to $412.96 in 2021.

The crypto crisis in 2022 affected all tokens. That led to a significant drop and today’s LTC value. However, this token only lost 82% of its worth compared to the all-time high. Considering that most crypto tokens lost over 90%, we can tell that’s a success.

Litecoin: Technological Roadmap

Litecoin doesn’t have an official roadmap, or at least they haven’t published it on the website. It doesn’t seem like major upgrades will occur anytime soon. The latest LTC halving event occurred in August 2023. Since the crypto undergoes halving every four years, the next event will happen in 2027.

The latest major upgrade, called Mimblewimble, indicated a huge turn in Litecoin’s history. The inspiration for the name Mimblewimble came from the Harry Potter books. It’s essentially a blockchain protocol that focuses on privacy. It protects the sender and receiver’s public wallet addresses. Mimblewimble won’t even display the coin balance in some situations.

That change led to Litecoin having problems with listing on some exchanges. Many platforms delisted LTC because it conflicted with regulations in their countries. No less than five South Korean exchanges, including Upbit, Korbit, and Bitthumb, decided to withdraw LTC. Another announcement noted that the US Litecoin Visa card hasn’t been available since May 2023.

Still, Mimblewimble indicates a major shift for Litecoin and makes it a true privacy token. That being said, it’s hard to expect any huge upgrades to this network anytime soon.

Price Prognosis for Litecoin

There’s one thing that all predictors agree on — Litecoin will be successful in the coming years. The level of success depends on the expert you ask. It’s likely that we won’t see any big changes in 2025. Some experts think LTC might reach $100 – 110. It seems more realistic that Litecoin will remain around its current value of $92.25. You can acquire it conveniently on Paybis.

The predictions vary significantly for 2026. More cautious experts put LTC value at $115 – 135, but some more optimistic believe that Litecoin could reach $150 – 200.

You can find similar forecasts for 2028. Cautious predictors say Litecoin will likely be worth from $120 to $200. Those who believe the new focus toward becoming a privacy coin will end up being a huge success put LTC at $212.34, and some even go as high as $305.

It’s harder to make a long-term forecast for any crypto. It will depend on how the entire market goes. But with the presumption that crypto will only become more popular, we can say that LTC will also profit. In 2030, Litecoin could be worth anywhere from $147 to $220. Optimistic investors put it over $400, and those who believe LTC is the next biggest hit place it at $600.

Forecasts for 2035 aren’t much different. You can find predictions putting LTC at $205.43 and others that put it over $1,000. We also found some predictions that warn LTC might not go over the current value over the years. The good news for Litecoin investors is that those forecasts are rare.

Bottom Line

LTC profiled itself as one of the most reputable altcoins. It’s a direct Bitcoin alternative, considering that it’s also an open-source P2P payment option.

Litecoin took a major turn with the Mimblewimble upgrade. It became a privacy-oriented token, which brought its pros and cons. The advantage is that users who appreciate maximum privacy will turn to LTC. The downside is that some exchanges already removed LTC from tradable tokens. Price predictions are mostly positive, so it seems that LTC will keep its position among reputable altcoins. If you agree with those assessments, now might be the right time to acquire Litecoin.

— Комментарии 0

, Реакции 1

Прокомментируйте первым