Cashing out may seem like a straightforward process, but there are important considerations that can significantly impact your returns. Understanding the intricacies of cashing out is vital for any online gambler aiming to maximize their earnings and ensure a seamless experience.

In this article, we delve into the world of cashing out online casino winnings, shedding light on the key factors you need to know to make the most of your gambling triumphs. I present steps you should take to make sure when you withdraw casino winnings you won't have any problem. So, let's delve into the world of cashing out and discover the top tips that will help you secure your online casino earnings with ease.

Understand the Cash Out Methods

When it comes to cashing out your online casino winnings, it's crucial to clearly understand the available withdrawal methods. Online casinos typically offer several options, each with its set of advantages and considerations. Let's explore the most common withdrawal methods and weigh their pros and cons.

Bank Transfers

One of the most traditional and widely used methods, bank transfers, allow you to directly transfer your winnings from your casino account to your bank account. This method offers convenience, especially if you prefer having your funds in your primary bank. However, it's essential to consider potential processing fees and longer transaction times associated with bank transfers. Additionally, ensure that your bank is compatible with online casino transactions.

E-Wallets

E-wallets, such as PayPal, Skrill, and Neteller, have gained immense popularity in the online gambling community due to their convenience and security. With an e-wallet, you can swiftly transfer funds between your casino account and your digital wallet. E-wallets often offer faster withdrawal processing times compared to other methods. However, be mindful of potential transaction fees and ensure that your chosen online casino supports your preferred e-wallet.

Checks

While less common these days, some online casinos still offer the option of receiving your winnings through a physical check. Checks can be a suitable choice if you prefer a tangible form of payment. However, keep in mind that they can be slower than other methods and may involve additional fees for processing or international delivery.

Which should I opt?

When choosing a withdrawal method, it's crucial to prioritize reliability and security. Opt for reputable and regulated online casinos that offer trusted payment providers. Consider the processing times associated with each method, as well as any applicable fees. Additionally, take into account your own preferences, such as whether you value speed or security in your payment method.

Review Terms and Conditions

Now is absolutely crucial to carefully review and understand the terms and conditions set forth by the casino. These guidelines outline the specific rules and requirements you must adhere to successfully withdraw casino funds. Here are some key points to consider:

Deposit Requirements

Many online casinos have policies that require you to make a certain deposit before you can initiate a withdrawal. This is a standard practice to ensure the security and legitimacy of transactions. Check here 5 deposit casino for CA players. It's essential to be aware of any deposit obligations and fulfill them accordingly.

Minimum Withdrawal Amounts

Online casinos often impose minimum withdrawal thresholds, which represent the minimum amount you must accumulate in winnings before you can request a withdrawal. Familiarize yourself with these requirements to ensure you meet the minimum threshold before attempting to cash out.

Withdrawal Limits

It's important to be aware of any maximum withdrawal limits imposed by the online casino. These limits may vary depending on the casino's policies, your chosen withdrawal method, or even your VIP status. Knowing these limits will help you plan your withdrawals accordingly and avoid any potential complications.

Associated Fees

Some online casinos may charge withdrawal fees, particularly for certain payment methods or when withdrawing funds below a certain threshold. Carefully review the terms and conditions to understand any applicable fees and factor them into your decision-making process.

Bonus and Promotion Restrictions

If you have utilized bonuses or participated in promotional offers, it's essential to understand any specific withdrawal requirements or restrictions associated with them. Some bonuses may have wagering requirements that need to be fulfilled before you can withdraw associated winnings. Failure to comply with these requirements could result in the forfeiture of bonus-related funds.

Verify Your Account

The typical verification process involves providing certain identification documents and proof of address. The exact requirements may vary between online casinos, but the following documents are commonly requested: Identification Documents (such as a passport, driver's license, or national identification card) and Proof of Address.

Be careful and follow these steps:

- Provide Clear and Valid Documents: Submit legible copies of your identification documents that clearly show all the necessary details. Avoid submitting blurred or cropped images that may cause delays in the verification process.

- Follow Instructions Carefully: Read the verification instructions provided by the online casino carefully and follow them closely. Failure to provide the requested documents or missing any required information may result in delays or complications.

- Be Responsive: Stay attentive to any communication from the online casino regarding your verification process. Promptly respond to any requests for additional information or documents to avoid unnecessary delays.

Plan Your Withdrawals Strategically

Planning your casino withdrawals strategically is key to maximizing your returns and minimizing any potential fees or delays. By considering factors such as withdrawal limits, fees, and processing times, you can ensure an efficient and cost-effective cashing out process.

Familiarize yourself with the withdrawal fees charged by the online casino and your chosen payment method. Some casinos may offer fee-free withdrawals for specific payment options or have reduced fees for higher VIP levels. By understanding the fee structure, you can minimize unnecessary costs when cashing out your winnings. Furthermore, different withdrawal methods have varying processing times. Some methods, such as e-wallets, offer faster withdrawals, while others, like bank transfers or checks, may take longer. Consider the urgency of your funds and decide a withdrawal method that aligns with your timing preferences. Additionally, keep in mind that weekends or holidays may impact processing times. Lastly, setting withdrawal goals can help you manage your funds effectively. Determine how much you want to withdraw and when. By establishing clear goals, you can avoid the temptation to play back your winnings and maintain a disciplined approach to cashing out.

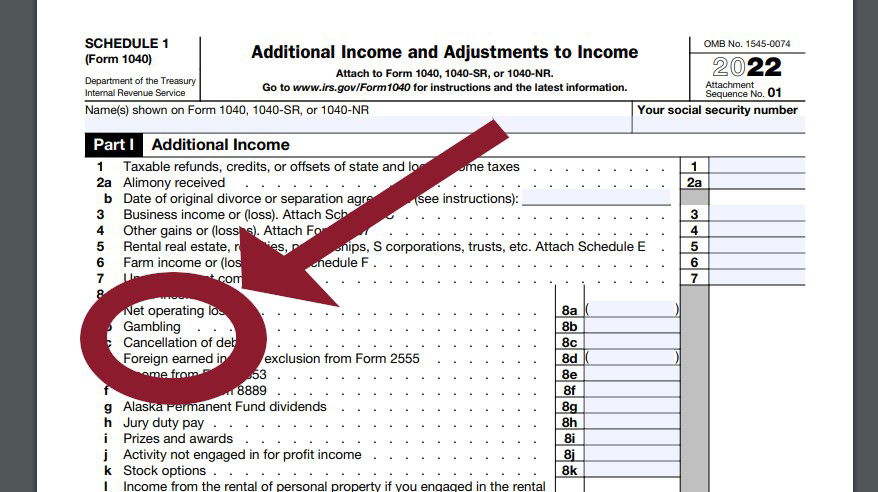

Be Aware of Tax Obligations

Some jurisdictions may classify gambling winnings as taxable income, while others may consider them as non-taxable windfalls. In the USA, according to the Internal Revenue Service (IRS), gambling winnings are considered taxable income. This means that any money you win from gambling must be reported on your tax return and is subject to federal income tax. Depending on where you live, you may also be required to pay state and local taxes on your gambling winnings.

Consult a Tax Professional! To navigate the complex landscape of tax obligations related to online casino winnings, it is advisable to consult a tax professional or accountant. They can provide tailored advice based on your specific circumstances and help you understand the tax laws in your jurisdiction. You can also check this article where we explain Taxes in Casino and which Form should you write to the IRS.

Regardless of the tax laws in your jurisdiction, maintaining accurate records of your gambling activities, including wins and losses, is crucial. This documentation can help you when reporting your income or losses to tax authorities, if required. Keep track of your transaction history, withdrawal statements, and any relevant tax forms provided by the online casino.

Frequently Asked Questions (FAQs)

Some questions should always be done before cashing out your winnings. Here are some:

1. What documents are typically required for identity verification?

The most common required documents are government-issued ID (passport, driver's license, national ID card, or any other government-issued photo identification) and proof of Address (utility bills like electricity, water, gas; bank statements, rental agreements, or official government letters that display your name and address).

2. Are there any withdrawal fees associated with cashing out winnings?

Withdrawal fees can vary depending on the online casino and the chosen withdrawal method. Some online casinos may impose fees for certain withdrawal methods or for withdrawals below a certain threshold. The fees can range from a fixed amount to a percentage of the withdrawn funds. It's important to review the terms and conditions of the specific online casino to understand if any withdrawal fees apply and factor them into your decision-making process when cashing out your winnings.

3. How long does it usually take to receive the withdrawn funds?

The processing time for withdrawn funds can vary depending on several factors, including the online casino and the chosen withdrawal method. Generally, e-wallet withdrawals tend to be faster, with funds typically being received within 24 to 48 hours. Bank transfers and checks may take longer, usually ranging from a few business days to a couple of weeks for international transfers. It's important to note that processing times may also be influenced by factors such as account verification, withdrawal amount, and the casino's internal processing procedures.

4. Can I cash out my bonus winnings immediately?

In most cases, you cannot cash out your bonus winnings immediately. Online casinos often impose wagering requirements that must be met before bonus winnings can be withdrawn. These requirements typically involve wagering a certain amount of money or playing a specific number of games before cashing out bonus-related winnings becomes possible.

Conclusion

It is vital to follow these tips to cash out your online casino winnings successfully. By understanding the withdrawal methods, complying with the terms and conditions, verifying your account, planning strategically, and being aware of tax obligations, you can navigate the process efficiently, maximize your returns, and enjoy a seamless and secure cashing out experience.

Remember, each online casino may have its own specific requirements and procedures, so it's crucial to adapt these tips to the specific guidelines provided by your chosen online casino.

— 评论 0

, 反应 1

成为第一个发表评论的人